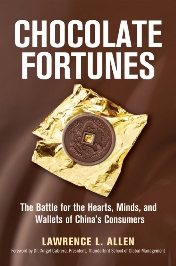

Lawrence Allen gets part of the credit for bringing kisses to China – the chocolate kind. After several years working in Taiwan and Hong Kong on behalf of familiar brands – Schick, Listerine, Conair – Allen started working for Hershey. He brought the famous bite-size treat to the mainland before moving on to work for Nestle. His experience was the fodder for Chocolate Fortunes: The Battle for the Hearts, Minds, and Wallets of China’s Consumers. He spoke with Zócalo on what chocolate means to the Chinese and how five global chocolate companies struggled to sell it to them.

Q. What is it about chocolate? How did it come to symbolize luxury and indulgence, and why choose it over other luxury products for your book?

Q. What is it about chocolate? How did it come to symbolize luxury and indulgence, and why choose it over other luxury products for your book?

A. Chocolate as you know has a long and glorious history with humanity. The cocoa bean has been cultivated for thousands of years in pre-Colombian Meso-America. It was a beverage consumed by the privileged classes, by the royalty, in that society. Even after it moved to Europe, with the Spanish conquest in the 1500s, it was still a beverage for the aristocratic class, and it was experienced as an exotic luxury. It took on this mystique of being a rare indulgence. It more or less stayed that way until the end of the 19th century, when solid milk chocolate was invented. Then it was packaged for the masses in the 20th century. But the mystique of chocolate as foreign, exotic, and indulgent stuck. When it arrived in China in the 1980s, some chocolate companies tried and failed to sell it as a snack food. Like everywhere else, it became a symbol of foreign, exotic indulgence, too.

I can’t explain why chocolate has been perceived this way by humanity, but it has to do with the deep emotional involvement people have with chocolate. It’s not a necessity, but a treat. That is really how chocolate is viewed around the world, China included.

To answer why I chose chocolate over other luxury food and drink, the main reason is I spent eight years in the industry in China with two companies, Hershey and Nestlé. So I had enough first-hand knowledge to write an entire book. That said, chocolate was a perfect choice. It had virtually no history or tradition in China. It was totally foreign. It might as well have been from Mars (the planet, not the company, of course). Chinese consumers were a clean slate when it came to chocolate. The big five chocolate companies – Hershey, Nestlé, Cadbury, Ferrero Rocher, and Mars – began to enter the market at about the same time and with zero brand awareness among Chinese consumers. It really was a level playing field – no one had any inherent advantage. These five companies obliged by taking different approaches, which resulted in different outcomes and made not only for an interesting story but offered practical business lessons about doing business in China. Exploring this stark contrast between Chinese austerity and chocolate indulgence demands that readers develop an understanding about Chinese consumers and the Chinese market in general.

Q. What were some of the early success or failures when the five companies first entered the Chinese market?

A. It depends on how you measure a success of failure. I suppose I can address the first real success, Ferrero Rocher. It’s a big global product, though it’s not too big in the States. It was invented in 1982. China opened its doors in 1978, but really nothing came in till the mid 1980s. It was difficult to even visit and get around in China, let alone begin building brands or selling products. But you look at a Ferrero Rocher gift box: there’s gold foil, and it’s very premium looking. That took off in Hong Kong, where people were into conspicuous consumption and brand images. As China began to open up more, people in Hong Kong who had family in China would come back for the Chinese New Year, and they would bring gifts. One of the popular gifts, almost by accident, was Ferrero Rocher. I do call them the accidental hero of the chocolate business in China. That was really the first impression consumers had of foreign chocolate, and what a great image to establish: foreign, exotic, indulgent, high-priced.

I’d say the first misstep of note would be Mars’s. In the late 1980s, they came to China. Their big brands are Snickers and M&Ms – M&Ms is a great product and everybody knows that it “melts in your mouth, not in your hands.” In China, we didn’t have air-conditioned stores or distribution, so M&Ms really fit the bill intellectually. It wouldn’t melt, and they could distribute it easily, it seemed the perfect product. Mars sponsored the 1990 Beijing Asian Games and promoted M&Ms. But consumers already had an impression of chocolate, and [M&Ms] looked like kids’ candy. They’re thinking, “I want this indulgent high-end experience,” and M&Ms weren’t it. From that initial misstep, the marketing director and country manager wondered what they had that consumers wanted. Coincidentally, the Dove chocolate bar – which is a derivative of Dove ice cream – had just become available. Mars had bought the ice cream brand in 1986. So they launched the Dove chocolate bar in China and that set them on the course to becoming the market leader.

Q. Which is the top brand in the U.S.? And are chocolates that seem more casual, like a Snickers, becoming more popular in China today?

Q. Which is the top brand in the U.S.? And are chocolates that seem more casual, like a Snickers, becoming more popular in China today?

A. You’d be surprised how hard it is to get accurate information on the chocolate industry. Each company phrases things in certain ways so they end up being leaders in one form or another. Mars, for example, has the number one candy bar in the world – Snickers is a $2 billion product. If you’re talking about pure chocolate bars, or chocolate with nuts, it’s certainly Hershey in the U.S. I’ve spent a lot of time watching consumers. I’ve literally stood in hundreds of retail stores in the U.S. and in China, you just stand there and watch how consumers buy. In the U.S., people walk past the chocolate aisle and grab their favorite without even thinking, or they’re at the cash register reading a magazine and they just grab some bars and throw them on the conveyor. In the U.S. it’s a regular, daily item. I think Americans are passionate about it, but still it’s an everyday thing. In China, it’s still largely a foreign treat. When you spend your life eating mainly fresh foods and not being too into dessert, you think about a chocolate bar, there’s no place for it in the cuisine. It has to be external, an occasional thing.

Q. How do you market a product to consumers that have never seen it, and perhaps don’t have a taste for it the way Americans might?

A. Again consumers here had a clean palate, there was no heritage of it in Chinese cuisine. That meant there was no taste preference – all products, from Cadbury Dairy Milk to Hershey’s Nuggets – were equal. In other markets tastes are pretty defined. Americans like Hershey, in the U.K., they prefer Cadbury. Once taste preferences are established, it’s really hard to get people to switch. As I described, chocolate was this exotic, foreign symbol of wealth. It’s only practical market entry point was as a gift and a novelty. In the late 1980s and early 1990s, chocolate was the fruitcake of China. Chocolate gift boxes were given and re-given until people became accustomed to eating it. Still, it was something to give, not to consume. But, the generation that grew up in the 1980s had a different culinary experience. Younger generations have now grown up eating KFC and McDonald’s, and have a broader palate and familiarity with more products. In the mid-1990s, self-consumption began to grow, with Mars and Cadbury driving it through the launch of chocolate bars. That’s when the chocolate market took off here. And Hershey actually hit on a very big thing by accident. If you came to a supermarket in China in the mid-1990s, you’d see Dove and Cadbury bars right next to the gift section. Hershey’s came in and said, this is a bar market. But these are 40 to 50 gram chocolate bars, and Chinese consumers don’t eat that much chocolate in a sitting. They nibble on a bar over a day or two. These chocolate bars were not “right sized” for Chinese consumers. So Hershey’s brought in Kisses, and they were flying off the shelves within a year. They read the market well. We were all in the dark in those days. In the U.S. you get these massive decks of research from Nielson and you know what’s moving in which stores and where, but in China it was really flying by the seat of our pants.

Q. Are there any native chocolate company rivals today?

A. Yes, but among consumers, they’re really not credible. If it’s tea, for instance, Chinese companies of course have credibility. A foreign company coming in and saying, “We’re tea experts,” it wouldn’t fly since they wouldn’t have the credibility. So for a domestic company to say, “We’re chocolate experts,” it’s not part of the chocolate experience – of foreign indulgence.

Q. What challenges have these companies faced when trying to get a foothold in this market?

A. I’d say the biggest challenge was certainly discerning a route to commercial success in China. What I mean by that is you had to deal with hardware problems and software problems. Hardware problems are those associated with China’s antiquated infrastructure and government bureaucracy. A phone call in the 1980s was a huge challenge. You had to write your number down and give it to a full-time phone dialer, who would sit and dial and redial until they got a line through. Today of course there are 400 million cell phones in use in China, so things have changed a little bit! But the big hardware problem for chocolate companies is the non-air-conditioned supply chain, just getting it to arrive not melted. A friend of mine would say that in India, chocolate means a half-melted Cadbury bar….

The software challenges were more difficult. I’ll give you an example. Some Chinese consumers believe that you can balance your body’s yin (cool) and yang (heat) with various foods. The body is said to have extra yin when you have a cold, when you’re menstruating, when you’re pregnant, so on. Foods that are thought to increase yin, like melons and cold drinks, are to be avoided. You eat foods with yang, like lamb, pepper, and chocolate. Conversely those afflicted with hypertension, acne, rashes, have excess yang and are not supposed to eat yang food. The west has something similar – people are told chocolate causes acne, and some recommend chocolate as a comfort food for menstrual cramps. There is something there. So in summer months, Chinese tend to consume less chocolate. These are the software things that executives had to understand-the most important issue was meeting these consumer expectations, important in any market, and more difficult in China because of lack of information and a rapidly evolving consumer. The companies’ biggest problem was internal, however. They had to be willing to sustain an investment in the Chinese market, not expect to turn a profit in two to three years. And they needed competent, consistent leadership. In one case, a company had six country managers in six years – it was chaos, people left in droves, and consumers took a back seat to all those issues. And they did not succeed with their chocolate business in China by any measure.

*Photo of Kisses courtesy mtsofan.

Send A Letter To the Editors