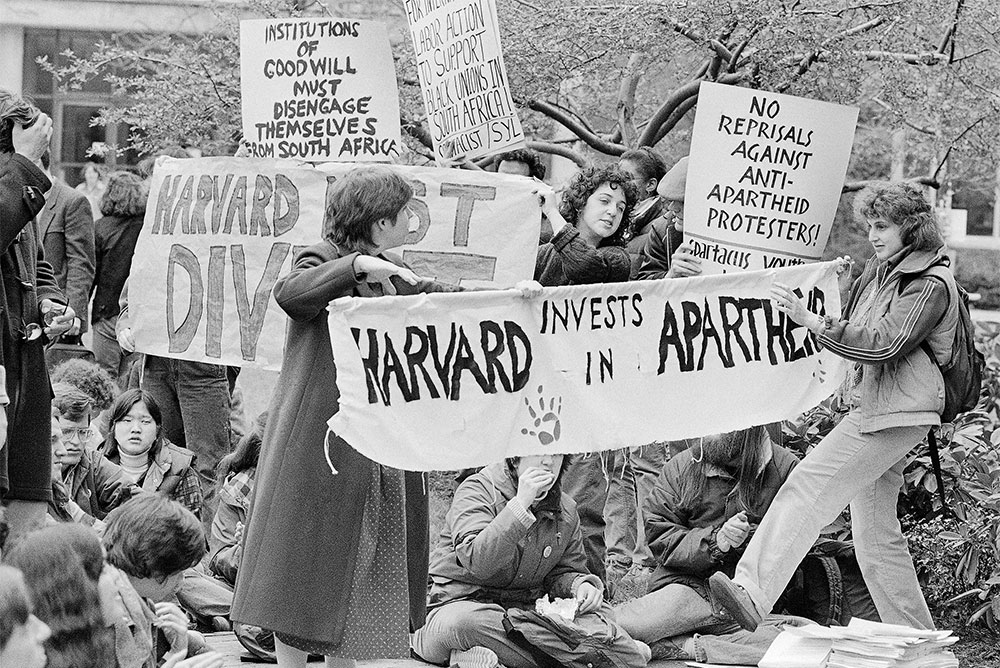

As part of a national campaign to protest U.S. companies’ involvement in South Africa, students protest outside the residence of the president of Harvard University on April 25, 1985. Courtesy of AP Images.

The environmental activist and writer Bill McKibben estimates that climate divestment—the movement to pressure universities, churches, and other institutions to stop investing in, and thus profiting from, carbon-emitting companies—has removed close to $15 trillion from investments in polluting companies, marking a significant victory for Planet Earth.

That’s an incredible achievement over the short span of a decade. However, climate divestment’s increasing visibility has also cultivated an audience of detractors who argue that it is ineffective. Bill Gates is famously skeptical of the benefits of divestment because it doesn’t directly stop carbon emissions the way innovation in new low-carbon technologies might. Other opponents claim that divestment cannot meaningfully change the demand for fossil fuels. Divestment might lower share prices, but according to these critics, those lower prices make them attractive to less ethical investors, making the strategy self-defeating. Going a step further, such critics even claim that divestment’s economic harm to companies has always been minimal—that it was so even in apartheid-era South Africa, where divestment as a tactic was born.

The problem with these critiques is that measuring divestment’s success solely on its financial impacts is a mistake. Focusing on short-term balance sheets obscures divestment’s true power: the strategy changes minds and mobilizes action, with effects that reach far beyond targeted investors and companies.

What happened in South Africa shows why this is the case. From 1960 through the 1980s, anti-apartheid activists were unable to persuade governments to push back against South Africa’s oppressive racial laws. American presidents, for example, were loath to act because South Africa was an important ally during the Cold War, acting as a regional policeman and actively warring against Marxist groups in neighboring countries. Individual congressmen were often sympathetic to imposing sanctions on South Africa, but overriding a president meant building a bipartisan movement—and creating consensus, even within a political party, took time. With governments unwilling to take action, activists in the United States and elsewhere had to look for different ways to undermine apartheid. They turned to divestment, refusing to invest in companies that did business in South Africa.

But divestment was not seen as a way to hurt the South African economy, or even to punish U.S. companies. In 1966, minister and activist George M. Houser, who helped found the American Committee on Africa (ACOA), a group dedicated to opposing colonialism in Africa, wrote a strategy paper advocating what he called “disengagement”—both withdrawing existing investments and prohibiting new ones. It reflected a growing consensus on how to strike at South Africa. At the time, ACOA was working with other groups to boycott Chase Bank (then known as Chase Manhattan Bank) because of its policy of lending to South Africa. “This campaign is not based upon the thesis that even if all of the economic power of the United States was brought to bear…the architects of apartheid would feel they had to accept new policies,” wrote Houser. Rather, he argued that this type of disengagement policy “would materially affect the outlook of many other powerful countries.” Houser’s model was the strategy that became divestment, and in many ways, continues to guide the movement today.

Initially, the tactic targeted specific companies and financial institutions who engaged in high profile projects in South Africa. In addition to the Chase campaign, Polaroid was targeted in 1970 for selling its photographic equipment for use in producing the hated passbooks used to control the movement of people in South Africa. Then, in the mid-1970s, activists began to pressure city and state governments to remove investments from companies working in South Africa.

Divestment gained steam with small victories, such as at Hampshire College in 1977 and the University of Wisconsin in 1978. Within a decade, companies found themselves constantly under criticism for their presence in South Africa. As divestments multiplied, some companies did decide to withdraw from the country.

But beyond these material effects, divestment had one huge effect that even Houser and others might not have fully foreseen: it helped build a truly national anti-apartheid movement in the United States. Up until divestment, the anti-apartheid movement in the United States saw limited success. While ACOA was technically a national committee, it was primarily a New York institution. During the Chase Bank campaign, the civil rights leader A. Philip Randolph referred to the anti-apartheid cause as “the germ of a movement.” Some activists launched consumer boycotts, but sustaining such efforts could be difficult, because many South African goods exported to the United States, such as platinum, could often be difficult to boycott. And as long as South Africa dodged the news cycle, it took the wind out of organizing sails. But divestment broke through. Where Houser was hoping to sway other countries into supporting sanctions, the strategy worked on the hearts and minds of people within the United States.

What made divestment different, and ultimately so popular? Some of it was moral appeal. It’s no coincidence that the movement gained strength quickly in churches and on college campuses: whether or not you could stop apartheid, profiting from it was immoral. Part of it, too, was political. Activists had great success reminding Americans that even as U.S. companies were shedding manufacturing jobs, they were taking advantage of cheap labor in South Africa. Amidst poverty in the United States, investments in an oppressive and immoral regime seemed doubly hypocritical.

Image created by Angus Crutcher.

But even more successful was the way that divestment created opportunities for action: in the words of activist Cherri Waters, “movements need something for people to do.” Divestment created tangible targets for people to organize around and against that were also specific to where they lived: university pension boards, church investment boards, and local governments. Lobbying these organizations was effective. Not coincidentally, this helped the movement to spread all across the country.

This widespread activation led many Republicans to endorse sanctions against South Africa against the wishes of Ronald Reagan. It simply became too difficult to ignore their constituents. Richard Lugar, a prominent Republican senator from Indiana, began supporting sanctions after complaining that he couldn’t go to his kids’ baseball games without constituents asking him what he was going to do about apartheid. Privately, Lugar was skeptical that sanctions would pass, but the pressure to do something simply became overwhelming. Congress authorized sanctions against South Africa in 1986, precisely because of that pressure.

The critics are right, in a way: divestment’s economic impact on companies was small during the anti-apartheid movement. Lowered U.S. share prices on their own were not economically damaging to South Africa. Even the withdrawal of businesses was largely a blow to South African morale.

But that doesn’t undercut the importance of divestment as a strategy. By increasing awareness of apartheid and the U.S. role in sustaining it, divestment activated a core of people who would support other actions against South Africa and beyond. This is the best way to understand divestment’s power then, and its power today. Stigmatizing companies and lowering investor confidence is important, but the tactic’s primary advantage is that it organizes people, gives them an action to accomplish, and leaves them open to pushing for even more substantive change.

Against climate change, which is not a human target and which isn’t an effect of the same sheer evil that undergirded apartheid, this approach is all the more critical. Whether it affects the bottom line or not, building a movement of people is what matters.

Send A Letter To the Editors